- Introduction

- What is 500k Life Insurance?

- Why Consider 500k Life Insurance?

- Types of 500k Life Insurance

- Factors Affecting 500k Life Insurance Premiums

- How to Find the Right 500k Life Insurance Policy

- Premium Breakdown for 500k Life Insurance

- Conclusion

-

FAQ about 500k Life Insurance

- What is 500k life insurance?

- How much does 500k life insurance cost?

- What does a 500k life insurance policy cover?

- Does 500k life insurance have cash value?

- What are the benefits of 500k life insurance?

- Who needs 500k life insurance?

- How do I apply for 500k life insurance?

- What happens if I die before the end of the policy term?

- Can I renew my 500k life insurance policy?

- What are the limitations of 500k life insurance?

Introduction

Hey readers,

Life is uncertain, and protecting your loved ones in the face of unforeseen events is paramount. That’s where life insurance comes into play, providing financial security and peace of mind for your family when you’re no longer around. One coverage option that strikes the perfect balance between affordability and protection is 500k life insurance. In this comprehensive guide, we’ll delve into the ins and outs of this policy, helping you make an informed decision about safeguarding your family’s future.

What is 500k Life Insurance?

500k life insurance is a type of life insurance that offers a death benefit of $500,000 to your beneficiaries upon your passing. It provides a substantial financial cushion, ensuring that your loved ones can cover expenses, pay off debts, and maintain their standard of living without facing financial hardship.

Why Consider 500k Life Insurance?

There are numerous reasons why individuals and families opt for 500k life insurance:

Affordable Coverage

500k life insurance offers ample coverage at a relatively affordable premium. Compared to higher coverage amounts, premiums are lower, making it more accessible for people with varying budgets.

Sufficient Financial Protection

A death benefit of $500,000 provides substantial financial security for your family. It can cover funeral expenses, mortgage payments, education costs, and other expenses that can arise after your passing.

Types of 500k Life Insurance

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. Premiums are typically lower than whole life insurance, and you can renew coverage when the term expires.

Whole Life Insurance

Whole life insurance offers coverage for your entire life as long as you continue paying premiums. It also accumulates a cash value component that you can borrow against or withdraw in case of emergencies.

Factors Affecting 500k Life Insurance Premiums

Several factors influence the cost of 500k life insurance:

Age

Premiums generally increase with age, as the risk of death rises.

Health

Your overall health and medical history play a significant role in determining your premium. Pre-existing conditions or lifestyle factors, such as smoking, can affect the cost.

Coverage Amount

The higher the death benefit, the higher the premium.

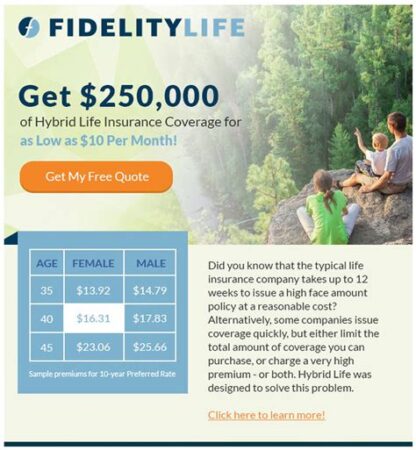

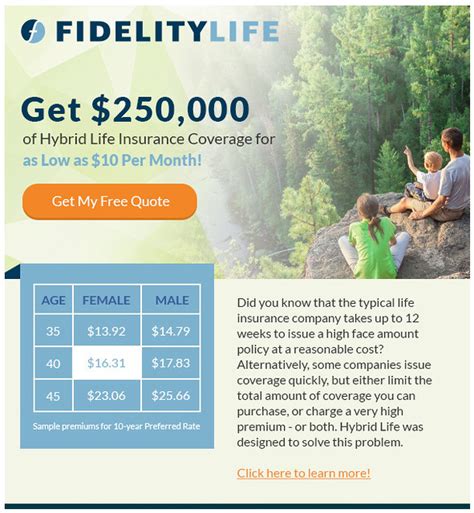

Gender

Statistically, women have a longer life expectancy than men, which can result in lower premiums for women.

How to Find the Right 500k Life Insurance Policy

To find the best 500k life insurance policy for your needs, consider the following steps:

Determine Your Coverage Needs

Assess your family’s financial obligations, expenses, and income to determine the appropriate coverage amount.

Research Insurance Companies

Compare quotes from multiple insurance providers to find the most competitive rates and coverage options.

Consider Rider Options

Riders are additional coverage features that can enhance your policy, such as disability income protection or accidental death benefits.

Consult with a Financial Advisor

A financial advisor can provide personalized guidance, help you navigate coverage options, and ensure you make an informed decision.

Premium Breakdown for 500k Life Insurance

| Age | Gender | Premium |

|---|---|---|

| 30 | Male | $420 |

| 30 | Female | $380 |

| 40 | Male | $540 |

| 40 | Female | $480 |

| 50 | Male | $780 |

| 50 | Female | $680 |

Note: Premiums are estimates and may vary based on individual factors.

Conclusion

500k life insurance offers a cost-effective yet comprehensive way to protect your loved ones’ financial future. By understanding the coverage options, premiums, and factors that affect policy choices, you can make an informed decision that ensures peace of mind for both you and your family. If you’re considering purchasing life insurance, take the time to research, compare policies, and consult with a financial professional to find the best coverage to suit your needs.

Read our other articles on life insurance:

- [Life Insurance for Seniors: Understanding Your Options](link to article)

- [Term vs. Whole Life Insurance: Which is Right for You?](link to article)

- [Life Insurance Riders: What You Need to Know](link to article)

FAQ about 500k Life Insurance

What is 500k life insurance?

Life insurance that provides a death benefit of $500,000 to beneficiaries upon the policyholder’s death.

How much does 500k life insurance cost?

Premiums vary based on factors like age, health, and lifestyle. Generally, a 30-year-old healthy person may pay around $20-$30 per month for a 500k policy.

What does a 500k life insurance policy cover?

Usually, it covers death from any cause, including accidents, illnesses, and natural causes. Additional riders can extend coverage to include specific events like accidental death or dismemberment.

Does 500k life insurance have cash value?

Most 500k life insurance policies are term life insurance, which does not accumulate cash value. However, some whole or universal life insurance policies may provide a cash value component.

What are the benefits of 500k life insurance?

Provides financial security for beneficiaries in the event of your death, covering funeral expenses, outstanding debts, and income replacement.

Who needs 500k life insurance?

Typically suitable for individuals with significant financial obligations, such as a mortgage, dependent children, or business assets.

How do I apply for 500k life insurance?

Contact an insurance agent or company. You will need to complete an application and provide health information.

What happens if I die before the end of the policy term?

Your beneficiaries will receive the $500,000 death benefit.

Can I renew my 500k life insurance policy?

Term life insurance policies typically expire after a set number of years. If you wish to continue coverage, you can often renew the policy for a higher premium based on your age and health at that time.

What are the limitations of 500k life insurance?

Some policies may have exclusions for specific causes of death, such as suicide or dangerous activities.